Lawrence Grassi | Glenobw Museum

Help us reach new heights!

Make an even bigger impact when you donate securities directly.

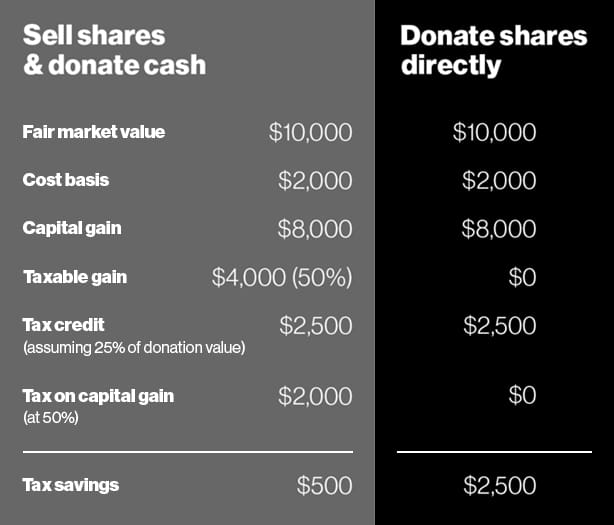

Discover the most tax-efficient way to make a gift to the Canmore Museum. By gifting securities directly to a charity as opposed to selling them and giving the proceeds, the capital gains tax can be eliminated. This means a greater donation for the charity and a greater charitable tax credit for you.

Why donate securities?

Your gift of securities entitles you to a donation receipt for the full market value (resale) of your contribution. Your gift will result in a non-refundable tax credit that will reduce your income taxes. You can use it in the year of your gift or carry it forward for up to five additional years.

You pay no capital gains tax on the appreciated value (increased price) of your securities. Donating securities directly to the Canmore Museum avoids the tax on capital gains, maximizes the return on your investment and protects the tax credits for use against other taxable income.

The chart below shows the tax advantage when you donate shares to the Canmore Museum instead of selling them and donating the proceeds. This calculation assumes a tax rate of 50%.

For more information or to make a donation of

securities or mutual funds, please contact:

Executive Officer

director@canmoremuseum.com

(403) 678-2462, extension 3